Life insurance sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. It serves as a cornerstone of financial planning, providing peace of mind to families by ensuring that loved ones are financially protected in the face of life’s uncertainties. Understanding the various types of life insurance policies available, from term to whole life, is crucial for making informed decisions that align with one’s personal and financial goals.

As we delve into the intricacies of choosing the right policy, it’s essential to consider the specific needs of your family and dependents. Life insurance can offer a safety net that allows families to maintain their standard of living during challenging times, making it a vital component of any sound financial strategy.

Understanding Life Insurance

Life insurance is a vital component of financial planning, serving as a safety net for families and dependents in the unfortunate event of a policyholder’s death. It ensures that loved ones are financially protected, covering expenses such as mortgage payments, education costs, and everyday living expenses, thus providing peace of mind during challenging times.

Life insurance policies come in various forms, each tailored to meet different needs and circumstances. The fundamental purpose of these policies lies in their ability to offer financial security and stability, making them an essential consideration for anyone looking to safeguard their family’s future.

Types of Life Insurance Policies

Understanding the different types of life insurance policies is crucial for making informed decisions. Each policy type has unique features and benefits, catering to various financial goals and situations. Below is an overview of the primary types of life insurance:

- Term Life Insurance: This policy is designed to provide coverage for a specified period, typically ranging from 10 to 30 years. It pays a death benefit only if the insured passes away during the term. Term life insurance is often more affordable compared to permanent policies, making it an attractive option for young families or individuals with temporary financial obligations.

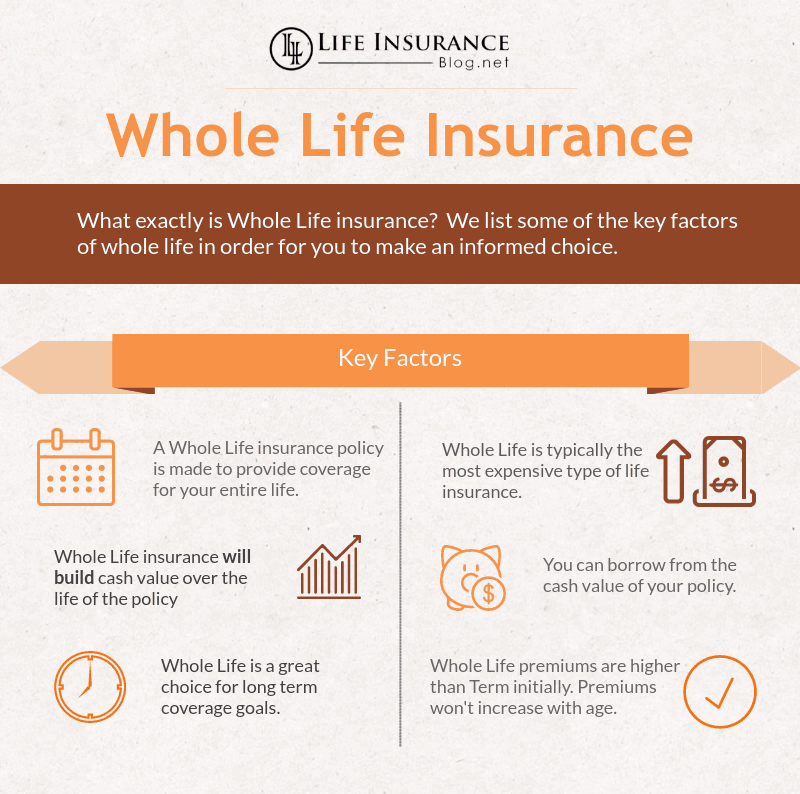

- Whole Life Insurance: This policy provides lifetime coverage and includes a cash value component that grows over time. Whole life insurance premiums are typically higher but ensure that beneficiaries receive a death benefit regardless of when the insured passes away. Additionally, policyholders can borrow against the cash value accumulated within the policy.

- Universal Life Insurance: This flexible policy combines life insurance with an investment savings account, allowing policyholders to adjust their premiums and death benefits. The cash value grows based on a credited interest rate, providing an opportunity for potential investment growth while maintaining life coverage.

- Variable Life Insurance: In this type of policy, the cash value and death benefit can fluctuate based on the performance of investment options chosen by the policyholder. While this offers the potential for higher returns, it also carries a higher risk, as the policy’s value may decrease if investments perform poorly.

- Final Expense Insurance: Specifically designed to cover funeral costs and other end-of-life expenses, this policy typically offers a smaller death benefit. It ensures that loved ones are not burdened with these costs during a difficult time, providing peace of mind and financial relief.

Importance of Life Insurance for Families and Dependents

Life insurance plays a crucial role in ensuring the financial stability of families and dependents in the event of an untimely death. It acts as a financial safety net, allowing surviving relatives to maintain their quality of life by covering essential expenses.

The significance of life insurance can be highlighted through the following key points:

- Debt Coverage: Life insurance can help pay off outstanding debts such as mortgages, car loans, or credit card balances, preventing loved ones from inheriting financial burdens.

- Education Funding: For families with children, life insurance ensures that funds are available to cover educational expenses, from elementary school through college, safeguarding the future of dependents.

- Income Replacement: The loss of a primary wage earner can significantly impact a family’s financial situation. Life insurance provides necessary funds to replace lost income, enabling families to sustain their lifestyle.

- Final Expenses: The cost of funeral services and related expenses can be substantial. Life insurance provides funds to cover these costs, alleviating financial strain during an emotionally challenging time.

- Estate Planning: Life insurance can play a strategic role in estate planning, ensuring that heirs receive the intended inheritance without the hassle of liquidating assets to cover taxes or debts.

Life insurance is not just about protection; it is about ensuring that your loved ones can continue to thrive even in your absence.

Choosing the Right Policy

Selecting a life insurance policy is a significant decision that can have lasting implications for both your financial future and that of your loved ones. It’s essential to navigate this choice carefully, understanding the different policies available and what factors influence their suitability for your individual needs.

When considering a life insurance policy, several key factors should be evaluated to ensure a well-informed decision. These factors include your financial obligations, the needs of your dependents, your health status, and your long-term financial goals. Each of these elements can greatly influence the type of policy that may be most beneficial for you.

Key Factors in Policy Selection

Understanding the nuances of life insurance will enable you to align your policy choice with your personal situation. Here are some crucial elements to consider:

- Financial Needs: Assess how much coverage you need based on your debts, income, and future financial responsibilities.

- Dependents’ Needs: Evaluate the financial support your dependents may require in your absence, ensuring they can maintain their standard of living.

- Health Considerations: Your health can impact your premiums and eligibility. Consider any pre-existing conditions that may affect your policy options.

- Premium Affordability: Ensure that the policy premiums fit within your budget without compromising your financial stability.

- Policy Flexibility: Look for policies that offer flexibility in terms of coverage adjustments and investment options.

Understanding the differences between term life and whole life insurance is crucial in making an informed decision.

Differences Between Term Life and Whole Life Insurance

Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. It is often more affordable and straightforward, making it a popular choice for those needing temporary financial protection. In contrast, whole life insurance offers lifelong coverage, with the added benefit of building cash value over time.

“Term life is suitable for those with short-term financial needs, while whole life serves as a long-term investment.”

Here’s a comparative overview of these two types of insurance policies:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (e.g., 10, 20, 30 years) | Lifetime coverage |

| Premium Cost | Generally lower | Higher premiums |

| Cash Value | No cash value accumulation | Builds cash value |

| Renewability | May require renewal, often at higher rates | Lifetime coverage without renewal issues |

| Ideal For | Those with temporary needs (e.g., mortgage, children’s education) | Those seeking lifelong protection and investment growth |

Choosing the right policy is essential, as it reflects both your immediate financial responsibilities and your long-term goals. Careful consideration of different policy types and features will empower you to make a choice that best suits your situation.

Benefits and Limitations: Life Insurance

Life insurance serves as a critical component of a well-rounded financial portfolio, providing peace of mind to policyholders and financial security to their beneficiaries. Understanding the benefits and limitations of life insurance is essential for making informed decisions that align with personal and family financial goals. This section explores the advantages of life insurance products and highlights common limitations and challenges associated with claiming benefits.

Advantages of Life Insurance

Life insurance offers several advantages that can significantly enhance one’s financial stability and security. These benefits are not only vital for the policyholder but also for their dependents. The following points Artikel key advantages:

- Financial Security for Dependents: Life insurance provides a financial safety net for dependents in the event of the policyholder’s untimely death, ensuring that loved ones can maintain their standard of living.

- Debt Coverage: Proceeds from a life insurance policy can be used to pay off outstanding debts such as mortgages, personal loans, and credit card balances, reducing the financial burden on family members.

- Cash Value Accumulation: Some policies, particularly whole life insurance, build cash value over time, which can be borrowed against or withdrawn, providing a valuable resource in emergencies.

- Tax Benefits: Life insurance death benefits are typically exempt from income tax, providing a tax-free inheritance for beneficiaries, which can be advantageous in estate planning.

- Peace of Mind: Having life insurance can provide peace of mind for policyholders, knowing that their loved ones will be taken care of financially in their absence.

Common Limitations and Exclusions in Policies

While life insurance provides substantial benefits, it also comes with limitations and exclusions that policyholders should be aware of. These restrictions can impact the coverage provided and the claims process. Key limitations include:

- Exclusions for Pre-existing Conditions: Many policies may not cover death related to pre-existing medical conditions, meaning that policyholders with certain health issues should review their options carefully.

- Suicide Clauses: Most life insurance policies include a suicide clause, which generally excludes coverage if the policyholder dies by suicide within the first two years of the policy.

- High-Risk Activities: Engaging in high-risk activities such as extreme sports or certain occupations may also result in exclusions or higher premiums.

- Waiting Periods: Some policies have a waiting period before the full benefits become available, which can delay financial support for beneficiaries.

Filing a Claim and Common Challenges

The process of filing a claim on a life insurance policy is crucial for beneficiaries to access the financial support intended for them. However, this process can sometimes present challenges. Understanding the steps involved and potential hurdles can prepare beneficiaries for what lies ahead.

The first step in filing a claim typically involves collecting essential documentation, which may include:

- The policyholder’s death certificate.

- Proof of identity for the beneficiary.

- The original life insurance policy or relevant policy number.

- Any additional documentation requested by the insurance company related to the cause of death.

Common challenges faced during the claims process include:

- Delays in Claim Processing: Insurance companies may take time to verify information and investigate claims, leading to delays in benefit disbursement.

- Disputes Over Policy Terms: Beneficiaries may encounter disputes regarding the interpretation of policy terms, especially when exclusions are involved.

- Insufficient Documentation: Incomplete or incorrect documentation can lead to claim denials or delays, emphasizing the need for thorough preparation.

“Understanding the intricacies of life insurance policies, their benefits, and limitations, can empower individuals to make informed decisions.”

Life Insurance Myths and Facts

Life insurance is often surrounded by misconceptions that can lead individuals to make uninformed decisions regarding their financial protection. Understanding the truths behind these myths is essential for making sound choices. This section aims to debunk common myths and highlight facts associated with life insurance to ensure clarity for potential policyholders.

Common Myths About Life Insurance

Numerous myths persist about life insurance that can misguide prospective buyers. Addressing these misconceptions is critical for making informed decisions. Here are some prevalent myths with factual corrections:

- Myth: Life insurance is only for older adults.

Fact: Life insurance can be beneficial at any age, particularly for those with dependents or financial obligations.

- Myth: Life insurance is too expensive to afford.

Fact: There are various affordable options available, and term life insurance can be particularly cost-effective.

- Myth: My employer’s life insurance is sufficient.

Fact: Employer-provided life insurance may not fully cover an employee’s needs, especially if they switch jobs or the coverage amount is inadequate.

- Myth: You don’t need life insurance if you are single.

Fact: Single individuals may still have debts or financial responsibilities that could benefit from life insurance.

Impact of Age and Health Conditions on Premiums

Understanding how age and health conditions influence life insurance premiums is essential for prospective policyholders. Generally, younger individuals are offered lower premiums primarily due to a decreased risk of mortality. As age increases, the likelihood of health issues also rises, resulting in higher premiums.

Health conditions significantly impact premium rates as insurers assess risk based on an individual’s medical history. For instance, a person with chronic conditions or a history of smoking may face higher premiums or even denial of coverage. It’s crucial to consider these factors when applying for life insurance.

Frequently Asked Questions About Life Insurance

Clarifying common inquiries can provide additional insights into life insurance. The following list addresses key concerns that potential policyholders may have:

- What factors affect life insurance premiums?

- How can I determine the right coverage amount for my needs?

- What types of life insurance policies are available?

- Can I change my policy once it’s been issued?

- How does one go about filing a claim after a death?

FAQ Corner

What is the primary purpose of life insurance?

The main purpose of life insurance is to provide financial protection to your dependents in the event of your untimely death.

How do premiums for life insurance work?

Premiums are the amount you pay for the policy, typically on a monthly or annual basis, and are determined by factors such as age, health, and the type of coverage.

Can I change my life insurance policy later?

Yes, many policies allow for adjustments or upgrades to coverage, but terms will vary by provider.

What happens if I miss a premium payment?

If you miss a payment, your policy may enter a grace period, but continuous non-payment could lead to policy cancellation.

Is life insurance taxable?

Generally, death benefits from life insurance are not taxable, but there are exceptions based on specific circumstances.

Finding affordable coverage can be challenging, but options like cheap insurance are available to help ease the financial burden. These policies often provide essential protection without breaking the bank, making them a viable choice for many individuals and families looking to safeguard their assets.

When it comes to reliable auto insurance, seguro geico stands out as a popular choice for many drivers. Known for its competitive rates and comprehensive coverage options, it offers peace of mind on the road while ensuring that you’re getting value for your money.