Car insurance is a vital safeguard for every vehicle owner, offering protection against unforeseen incidents while driving. Understanding the nuances of car insurance can empower you to make better choices, ensuring you have the right coverage tailored to your specific needs. Whether you’re a first-time buyer or looking to reassess your current policy, delving into the world of car insurance reveals a complex landscape of options and considerations that can ultimately save you money and enhance your peace of mind.

From comprehending different types of policies and their components to identifying key factors that influence your rates, knowing the ins and outs of car insurance is essential. The importance of liability coverage and how it impacts not only your finances but also your legal standing cannot be overstated. By exploring the best practices for reducing costs and navigating the claims process successfully, you’ll be better prepared to handle anything the road throws your way.

Understanding Car Insurance Basics

Car insurance is an essential aspect of vehicle ownership, designed to protect drivers financially in the event of accidents, theft, or damage. Understanding the intricacies of car insurance can help consumers choose the right policy for their needs and avoid unexpected expenses.

Different types of car insurance policies cater to various needs, providing a range of coverage options. These policies can vary significantly in terms of price and protection level, making it crucial to understand their distinct features.

Types of Car Insurance Policies

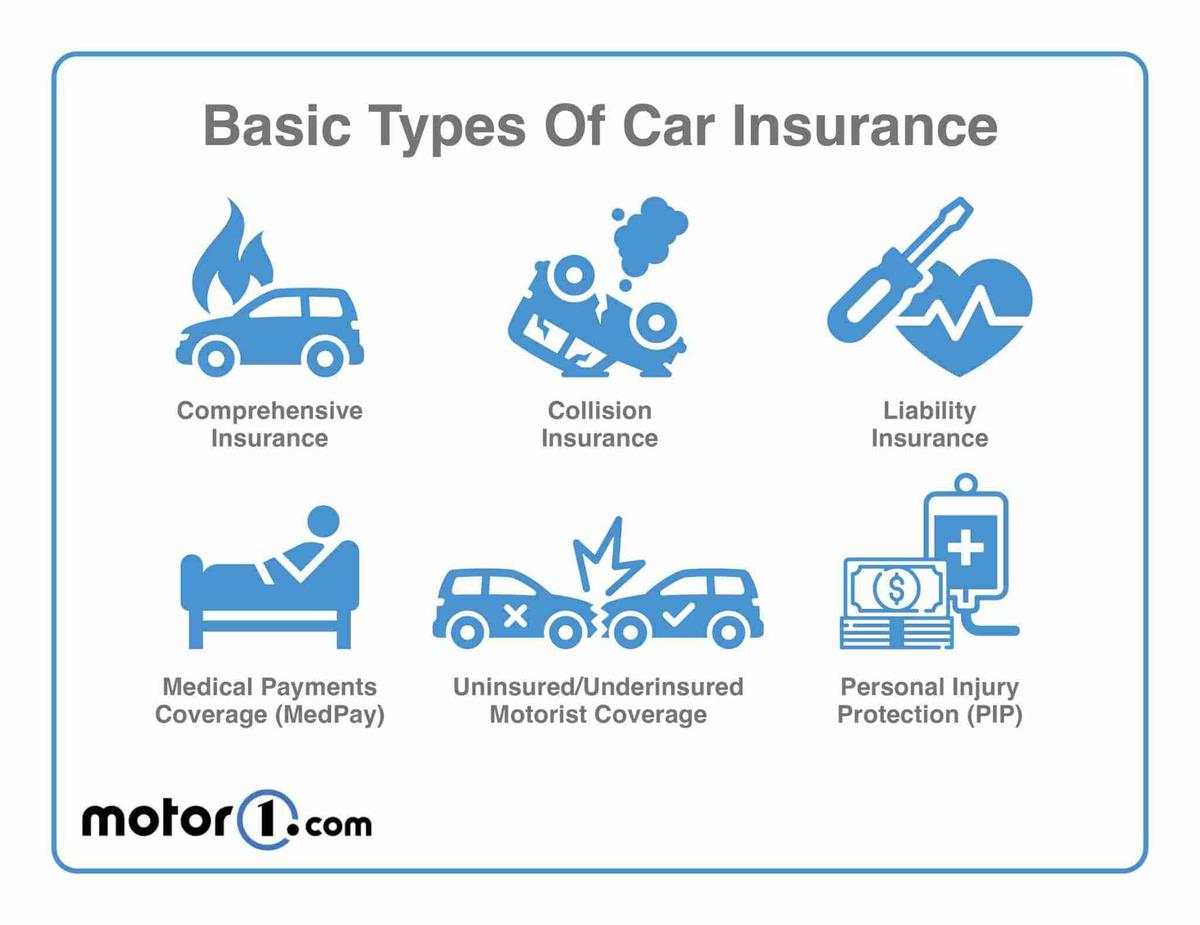

Several types of car insurance policies exist, each offering unique benefits and coverage levels. The following are the most common types:

- Liability Insurance: This is the most basic form of car insurance, covering damages to other people and their property in the event of an accident where you are at fault. Most states require a minimum level of liability coverage.

- Collision Coverage: This type helps pay for damage to your vehicle resulting from a collision, regardless of fault. It is especially useful for newer or more expensive cars.

- Comprehensive Coverage: Comprehensive insurance covers non-collision-related incidents, such as theft, vandalism, or natural disasters. This provides peace of mind for unforeseen events.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers in the event of an accident, regardless of fault, including lost wages and rehabilitation costs.

- Uninsured/Underinsured Motorist Coverage: This policy protects you in cases where the other driver is uninsured or lacks sufficient coverage to pay for damages.

Factors Affecting Car Insurance Premiums

Several key components influence car insurance premiums, shaping how much a customer pays for coverage. Understanding these factors can help individuals make informed decisions when selecting a policy.

- Driving Record: A clean driving record can significantly lower premiums, while incidents such as accidents or traffic violations may increase rates.

- Vehicle Type: The make, model, and safety features of your vehicle affect insurance costs. More expensive or high-performance cars usually incur higher premiums.

- Location: Where you live can impact your premium, as urban areas with higher traffic and crime rates often lead to higher insurance costs.

- Coverage Level: Choosing higher coverage limits and additional policies can raise your premium, while opting for a higher deductible can lower it.

- Credit Score: In some regions, insurers use credit scores as a factor in determining premiums; a better credit score can lead to lower rates.

Importance of Liability Coverage

Liability coverage is crucial as it serves as a financial safety net in the event of accidents that lead to bodily injury or property damage to others. Without this coverage, drivers risk facing substantial out-of-pocket expenses and potential legal repercussions.

“Liability coverage is not just a legal requirement in many states but also a vital protection against unexpected financial burdens.”

The implications of inadequate liability coverage can be severe, potentially leading to lawsuits or significant financial difficulties if involved in a major accident. Therefore, it is essential for drivers to adequately assess their liability coverage needs based on their driving habits, vehicle type, and financial situation.

Factors Influencing Car Insurance Rates

Understanding the various factors that influence car insurance rates is essential for drivers seeking to manage their costs effectively. Insurance companies use a comprehensive approach to assess risk, evaluating multiple elements that contribute to the determination of insurance premiums. By recognizing these factors, policyholders can make informed decisions when shopping for car insurance.

One of the primary elements that affects car insurance rates is the driver’s history. Insurers assess a driver’s past behavior on the road, including any accidents, traffic violations, and claims made. These factors serve as indicators of risk, with a clean driving record generally leading to lower premiums. In addition, credit scores play a significant role; studies have shown that individuals with higher credit scores often receive better rates. This correlation exists because insurers view credit scores as a predictor of reliability and responsibility, thereby linking financial behavior to driving behavior.

Driving History and Its Impact on Premiums

A driver’s history is meticulously analyzed by insurance providers to gauge the likelihood of future claims. Several key aspects include:

- Accidents: Each accident on record can elevate premiums significantly, particularly if the driver was found at fault.

- Traffic Violations: Tickets for speeding, reckless driving, or DUIs can lead to increased rates as they indicate poor driving behavior.

- Claims History: Frequent claims, even if minor, can mark a driver as high-risk, leading to higher premiums.

- Time Since Last Violation: A longer period without incidents can help lower rates, reflecting improved driving habits.

Insurers may consider additional factors, such as the type of violations (minor vs. major) and the recency of these events, which can have a varying impact on the overall premium.

Credit Scores and Insurance Costs, Car insurance

Credit scores are another critical factor influencing car insurance rates, as they serve as a predictive measure for insurance companies. The following points illustrate how credit scores affect premiums:

- High Credit Score: Individuals with excellent credit are often rewarded with lower premiums, reflecting the insurer’s belief in their reliability.

- Low Credit Score: Conversely, a poor credit score can lead to higher rates due to perceived higher risk.

- Credit Score Improvements: Policyholders can sometimes negotiate lower rates after improving their credit scores, demonstrating responsible financial behavior.

Insurance companies utilize complex algorithms to analyze credit information, which may include payment history, outstanding debt, and credit utilization rates.

Vehicle Make and Model Variations

The type of vehicle being insured significantly impacts premium rates. Different makes and models come with varying levels of risk, which insurers take into account. Important considerations include:

- Safety Ratings: Cars with high safety ratings typically incur lower insurance costs as they are less likely to result in severe injuries and expensive claims.

- Repair Costs: Vehicles that are costly to repair or have high theft rates often lead to increased premiums.

- Performance and Engine Size: High-performance vehicles or those with larger engines may be associated with riskier driving, resulting in higher rates.

- Age of Vehicle: Newer models may have advanced safety features, which can reduce premiums compared to older vehicles with fewer safety options.

In summary, car insurance companies employ a wide range of factors when determining rates. By understanding how driving history, credit scores, and vehicle specifics influence costs, drivers can make more strategic decisions when it comes to their insurance policies.

Tips for Reducing Car Insurance Costs

Navigating the world of car insurance can often feel overwhelming, especially when it comes to managing costs. However, there are several practical strategies that can help you lower your premium while still securing the coverage you need. By understanding your options and making informed decisions, you can effectively reduce your car insurance expenses.

When selecting coverage, it’s essential to evaluate your specific needs carefully. While it might be tempting to opt for the lowest premium available, understanding the implications of different coverage levels is crucial. Here are some strategies to help minimize your expenses:

Choosing the Right Coverage Options

The right coverage can drastically affect your insurance costs. While you want to ensure that you are adequately protected, you also don’t want to pay for unnecessary features. Consider the following options:

- Assess Your Coverage Needs: Evaluate how much coverage you truly require based on your vehicle’s value and your driving habits. For example, if you drive an older car, it might not make financial sense to carry comprehensive coverage.

- Increase Your Deductible: Opting for a higher deductible decreases your premium. However, ensure that you can afford the deductible amount in case of a claim.

- Limit Optional Coverage: Optional add-ons, such as rental car reimbursement or roadside assistance, can be beneficial but might not be necessary for everyone. Consider whether these options are worth the extra cost for your situation.

In addition to selecting the right coverage, bundling your insurance policies can yield significant savings. Many insurance companies offer discounts for customers who have multiple policies with them.

Bundling Insurance Policies

Bundling your car insurance with other forms of insurance can be a smart way to save money. Here’s how it can benefit you:

- Single Provider Convenience: Having all your policies with one insurer simplifies management and can lead to more streamlined customer service.

- Discounts: Insurance companies often provide significant discounts when you bundle. For example, a homeowner who also insures their car with the same company may save up to 25% on their auto policy.

- Increased Loyalty Benefits: Long-term customers often have access to loyalty programs that offer additional savings and perks.

Another important factor that can influence your car insurance rates is your credit score. Maintaining a good credit score can have a positive effect on your premiums.

Maintaining a Good Credit Score

Insurance companies frequently use credit scores to assess risk, which means a better score can lead to lower premiums. Here are some insights into how your credit score impacts your insurance costs:

- Insurance Score Connection: Insurers may use a credit-based insurance score to determine your likelihood of filing a claim. A higher score typically indicates lower risk to insurers.

- Long-term Savings: Maintaining a good credit score not only enhances your chances for lower premiums but can also result in more favorable terms when applying for loans or mortgages.

- Regular Monitoring: Regularly check your credit report for errors and pay your bills on time to help maintain a healthy credit score.

By employing these strategies—selecting the right coverage options, bundling policies, and maintaining a good credit score—you can take significant steps towards reducing your car insurance costs while ensuring you are protected on the road.

Navigating the Claims Process

Filing a car insurance claim can often be a daunting experience, especially in the aftermath of an accident or damage to your vehicle. Understanding the claims process is essential to ensure you receive the compensation you are entitled to without unnecessary delays. This section details the steps for filing a claim effectively, highlights common pitfalls to avoid, and Artikels the necessary documentation for a successful claim.

Step-by-Step Process for Filing a Car Insurance Claim

When faced with the need to file a car insurance claim, following a structured approach can help streamline the process. Here’s a step-by-step guide to assist you:

1. Notify Your Insurance Company: Contact your insurer as soon as possible after the incident. Most companies have a specific timeline within which claims must be reported.

2. Gather Information: Collect all relevant information, including the date, time, and location of the accident, as well as details of other parties involved. This includes names, addresses, phone numbers, and insurance information.

3. Document the Incident: Take photos of the accident scene, vehicle damage, and any visible injuries. This visual evidence can support your claim.

4. File the Claim: Complete the claim form provided by your insurer, ensuring that all details are accurate and comprehensive. Submit the form as directed, whether online, via email, or by mail.

5. Follow Up: After submission, keep in touch with your insurance adjuster to track the progress of your claim and provide any additional information they may require.

Common Pitfalls to Avoid When Submitting a Claim

Awareness of potential mistakes can enhance your chances of a successful claim. Here are some pitfalls to avoid:

– Delaying Notification: Failing to notify your insurance company promptly can lead to complications or denial of your claim.

– Inaccurate or Incomplete Information: Providing incorrect details can slow down the claims process. Double-check all information before submission.

– Admitting Fault: Avoid making statements that could be interpreted as admitting fault at the scene of the accident or in your initial report.

– Not Keeping Records: Failing to document all communications, including phone calls and emails with your insurer, can lead to misunderstandings.

Documents and Information Required for a Successful Claim Submission

To facilitate a smooth claims process, it is crucial to gather all necessary documents before filing. The following list Artikels the essential information needed for a successful claim submission:

– Claim Form: Completed form as provided by your insurance provider.

– Police Report: If applicable, include a copy of the police report detailing the incident.

– Photos of the Damage: Clear images of the vehicle and surroundings can provide visual evidence to support your claim.

– Witness Statements: Collect statements from any witnesses to the incident, if available.

– Medical Records: If injuries were sustained, documentation of medical treatment may be required.

– Estimates for Repairs: Obtain written estimates from repair shops, if applicable.

– Insurance Policy Details: Ensure you have a copy of your insurance policy handy for reference.

– Correspondence Records: Maintain a log of all communications with your insurer, including dates and names of representatives spoken to.

By adhering to this structured approach and being mindful of common pitfalls, you can navigate the claims process more effectively, minimizing stress and maximizing your chances for a favorable outcome.

Quick FAQs

What is the minimum car insurance required by law?

The minimum car insurance required varies by state, but it typically includes liability coverage for bodily injury and property damage.

How can I lower my car insurance premiums?

You can lower your premiums by maintaining a good credit score, bundling policies, increasing your deductible, and comparing quotes from multiple insurers.

What should I do if I have an accident?

If you have an accident, ensure everyone’s safety first, then document the scene, exchange information with other parties involved, and notify your insurance provider as soon as possible.

Can I change my car insurance policy at any time?

Yes, you can change your car insurance policy at any time, but be aware of potential fees or penalties associated with early cancellations.

How often should I review my car insurance policy?

It’s advisable to review your car insurance policy annually or when significant life changes occur, such as moving, changing vehicles, or adding a driver.

When considering your home, securing it with the right home insurance is crucial. This insurance not only protects your property from unforeseen events but also provides peace of mind. Understanding the coverage options can help you choose the best plan tailored to your needs, ensuring that you and your belongings are well-protected.

If you are looking for comprehensive coverage in Spanish, freeway insurance español can offer tailored solutions. This service caters specifically to the Spanish-speaking community, providing an easy-to-understand approach to insurance. By breaking down complex terms, they ensure that everyone can make informed decisions about their coverage.